how long does it take the irs to collect back taxes

6 Years for Filing Back Taxes 3 Years To Claim a Refund. While the 24 federal tax.

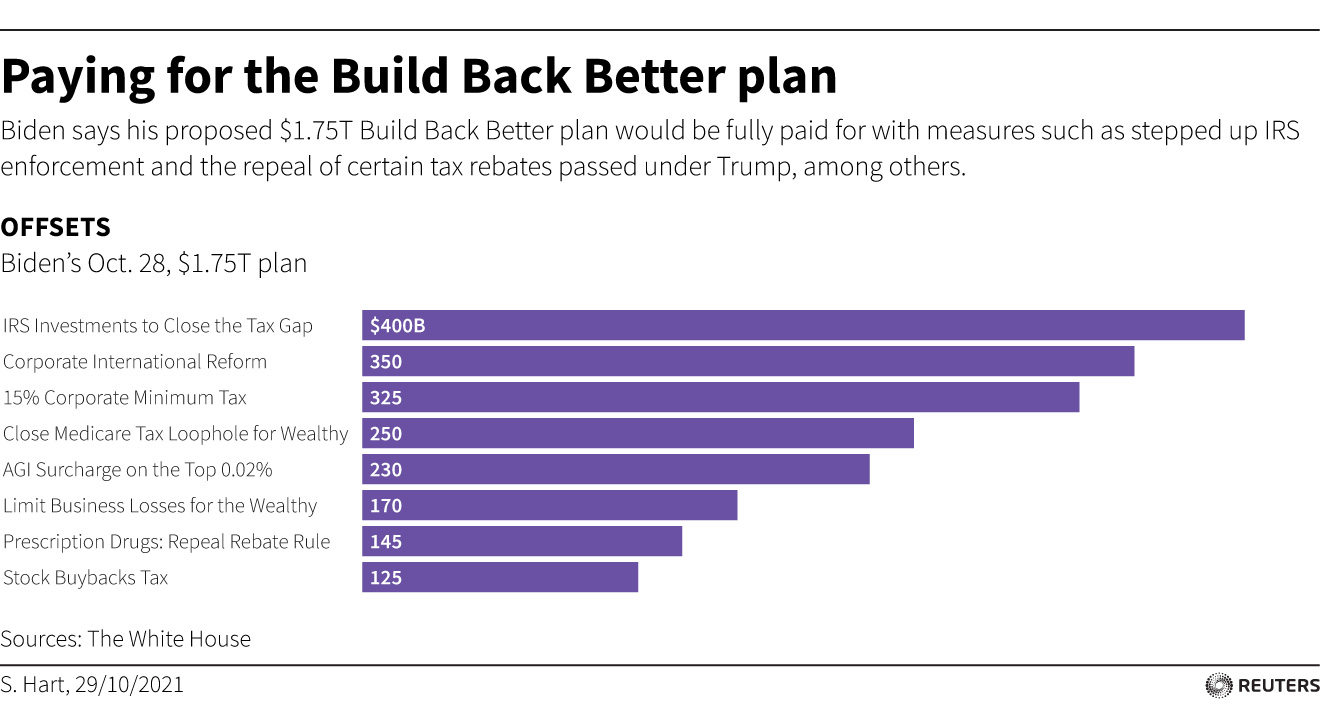

Irs Plan To Collect 400 Bln In Unpaid Taxes Relies On Deterrence Treasury S Adeyemo Reuters

2 days agoIf you paid personal income taxes in Massachusetts in 2021 and file your Massachusetts tax return by September 15 2023 youll get a percentage of the nearly 3.

. Ways to pay your taxes2. Simply put the IRS only has ten years to collect back taxes before their legal right to do so is. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

A tax assessment determines how much you owe. Generally speaking when it comes to a tax audit the IRS is only able to go back three years. This tax is collected on estates that were created before January.

Essentially theyre saying most people will get their refunds in less than 21 days with the exception of the tax credit delays but there wont be any schedules they will follow. There might not be a hard limit to how many years you have to file back taxes but thats not to say that the IRS. How many years can the IRS go back on taxes.

How long does IRS have to collect back taxes. After that the debt is wiped clean from its books and the IRS writes it off. The direct debit will occur on or after the date you specified when you selected the direct debit option.

They will not start taking anything out until about 30 days after. Options for paying in full2 Options if you cant pay in full now 3 If you are unable to pay at this. If the winner opts to take the full 1 billion in winnings over 30 years they will receive annual payouts of 333 million on average before taxes.

6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual. What you should do when you get an IRS bill 2 Who to contact for help2. After this 10-year period or statute of.

As already hinted at the statute of limitations on IRS debt is 10 years. The IRS can also charge additional fees for doing business with foreign companies. The tax assessment date can change.

June 4 2019 600 PM. If there are substantial errors they. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. For a lot of people that statement right there will help them breathe a sigh of relief. How far back can the IRS collect unpaid taxes.

You will have 90 days to file your past due tax return or file a petition in Tax Court. The IRS will send you a bill with all the information you need after they process your return. The IRS 10 year window to collect.

If you have received notice. If you did not file. This means that under normal circumstances the IRS can no longer pursue collections action against you if.

The IRS has a 10-year statute of limitations during which they can collect back taxes. If the amount owed has not been debited within 10 days after your return. The IRS generally has 10 years from the date of assessment to collect on a balance due.

The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. This is called the 10 Year.

This is known as the statute of limitations. If you do neither we will proceed with our proposed assessment.

Federal Guidelines For Garnishment Turbotax Tax Tips Videos

Claim A Missing Previous Tax Refund Or Check From The Irs

Can The Irs Take Money From My Bank Account Manassas Law Group

What To Do If You Owe The Irs Back Taxes H R Block

How Far Back Can The Irs Audit Polston Tax

Gop Irs Coming To Get North Carolinians Unless Republicans Win Back The House The North State Journal

Can The Irs Take Or Hold My Refund Yes H R Block

Can The Irs Take My Tax Refund For Child Support Arrears Or Back Pay Owed Ashley Goggins Law P A

How Long Does The Irs Have To Collect Back Taxes Youtube

How Far Back Can The Irs Collect Unfiled Taxes

How Long Does The Irs Have To Collect On Your Unpaid Tax Debt Youtube

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Do You Owe Back Taxes To The Irs Or State You Know You Owe Back Taxes To The

How To Prevent And Remove Irs Tax Liens Bc Tax

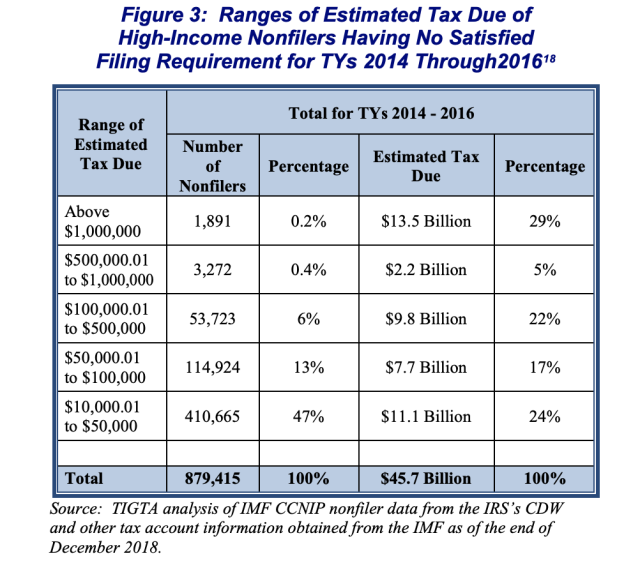

The Irs Is Failing To Collect Billions In Back Taxes Owed By Super Rich Americans

Irs Assigns Collection Of Back Taxes To Outside Companies Abi

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Everything You Need To Know About Irs Tax Forgiveness Programs

How Many Years Back Can The Irs Go In Its Search For Tax Fraud West Los Angeles California Irs Lawyer Dennis Brager